Black Friday and Cyber Monday are now in the rearview mirror, giving brands and retailers a much-needed breather before finishing off the shopping season. So how exactly did online retail perform this year, and what were some significant changes in consumer spending and behavior during Cyber Week 2023?

Panelists from BigCommerce and Feedonomics got together to answer these questions and more! The panel included the following speakers:

Matt Dornfeld, Senior Director, Head of Global Partnerships at Feedonomics

Meghan Stabler, Senior Vice President of Marketing at BigCommerce

Melissa Dixon, Director of Brand and Content Marketing at BigCommerce

In this blog, we cover some of the highlights from their discussion, including what worked for retailers this year and what brands can do to finish off the holiday season strong.

Ecommerce sales were up this year

Overall, the panelists noted that Cyber Week ecommerce spending grew both in the U.S. and globally, citing figures from Adobe, Salesforce, and BigCommerce.

Adobe reported an increase of 7.8% year-over-year (YoY) for U.S. ecommerce spending during Cyber Week 2023. Globally, Salesforce reported a growth of 6% YoY.

BigCommerce data shows a gross merchandise value (GMV) increase of 8% YoY on Black Friday and 12% GMV YoY on Cyber Monday among its customers.

According to Dornfeld, Feedonomics clients saw their order volume grow by approximately 17% YoY on Black Friday and 22% on Cyber Monday.

“Similarly, overall GMV increased as well,” Dornfeld said. “So, that tends to go hand-in-hand with order volume, but we saw a 28% increase year-over-year on Black Friday alone, and then another 22% on Cyber Monday. So tremendous, tremendous growth.”

Retailers are blending online and offline commerce

One theme panelists touched on was how retailers leveraged both their brick-and-mortar and online channels to drive sales.

According to a Salesforce report, 24%-25% of orders between Black Friday and the following Sunday used buy online, pick up in store (BOPIS) fulfillment. BOPIS and curbside pickup were popular fulfillment options during the pandemic, and have retained their popularity post-pandemic.

Omnichannel sellers can use local inventory ads to highlight the availability of this fulfillment option and drive more customers to their physical storefronts.

“A lot of these retailers are starting to roll out new services,” Dornfeld said. “So, BOPIS is a huge one, but really leveraging brick-and-mortar locations as fulfillment centers as well. So that really enables a brand to move more quickly, deploy more inventory to people that are local to those stores, and I think we’ll see a lot more of that out of our major retailers over the next year to come.”

Mobile and social commerce performed

Mobile commerce drove 79% of global traffic to retailer sites during Cyber Week, and social channels accounted for 10% of that traffic, according to Salesforce.

“I think the thing for brands and retailers to keep in mind is that [social media] is number one for product discovery,” Dixon said. “So people are shopping there—whether or not they’re completing the purchase through social media channels today, it’s still necessary to be there.”

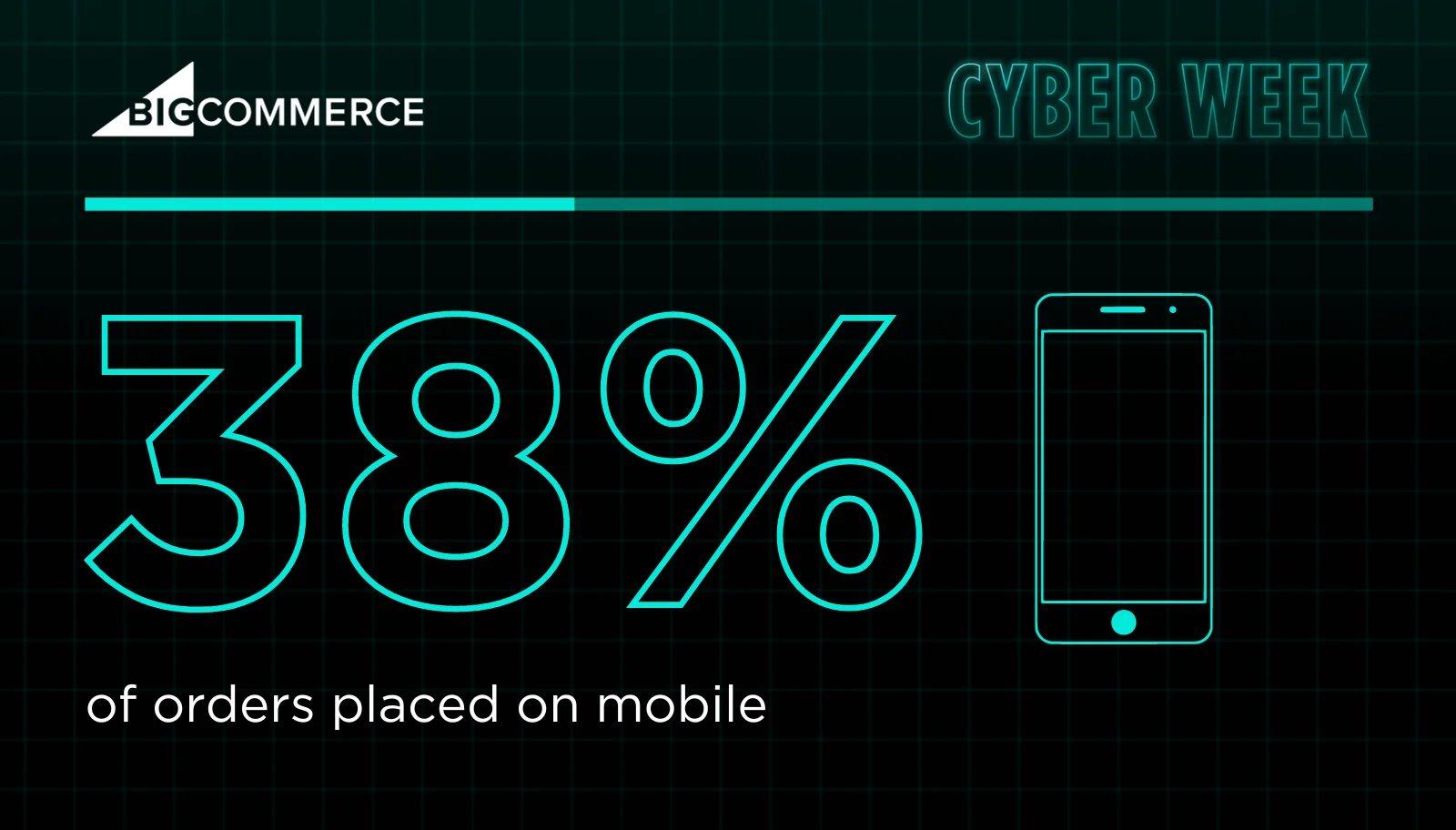

BigCommerce reported that 38% of orders were placed on mobile, and sales on mobile devices increased by 13% YoY.

Adobe figures show that smartphones drove 51.8% of online sales in the U.S., about two percent higher than in 2022.

Looking into the future

Panelists gave their recommendations to online retailers about how to handle the rest of the holiday season, and what changes they could make in 2024.

Stabler suggests brands be more aware of consumer savviness and sensitivity to being advertised to. To make up for this, she recommends that ecommerce marketing managers take a more thoughtful, personalized approach to promoting their products.

“Consumers are still expecting that personalized experience, so don’t over-rotate on trying to convince [them] to buy something,” Stabler said. “Do it in a very judicious way.”

Stabler also recommended that retailers adjust their tech stack to the changing expectations of consumers. For example, consumers have begun expecting more communication about delivery status, and faster delivery times, which means brands will need to streamline their order management systems to keep up.

Dornfeld recommended retailers take advantage of the customer data they have acquired over Cyber Week. He recommends that retailers invest in an omnichannel data strategy to help them uncover more information about customer behavior, like which channels they visit, and how they interact with those channels.

“Data is kind of like lettuce,” he said. “Let that sit for too long, you don’t want to eat it anymore.”

Need help planning your omnichannel strategy for 2024?

With its leading data feed management platform, Feedonomics helps brands, retailers, and agencies optimize and list products on hundreds of shopping destinations around the world. Learn more about our full-service solutions for advertising channels and marketplaces.