From query to cart, artificial intelligence is shaping every step of product discovery. Customer behavior has changed so much that today, nearly 60% of consumers prefer AI product recommendations over traditional search.

In our last article on AI-powered product discovery, we explored how AI interprets search queries and finds relevant products. But relevance is only the beginning. AI search engines improve the user experience by providing personalized recommendations, too.

Once a product is deemed relevant, AI systems have to answer two critical questions: Should this product be shown among the limited results? And if so, where should it rank among dozens of similar listings?

These decisions are what determine if a product is visible or obscure, and can make the difference between a sale and a missed opportunity. For sellers, understanding how AI-powered recommendation engines make decisions is key for improving marketing strategies and conversion rates.

In this article, we’ll unpack what sellers need to know to improve AI search ranking:

- Why some products never get recommended in the first place (eligibility and visibility barriers).

- Why other products rise above the competition (the signals that influence ranking once you’re eligible).

- What sellers can do right now to optimize for AI algorithms, improve product visibility, and boost conversion rates.

By the end, you’ll have a practical framework for diagnosing why your listings may be underperforming, and an action plan for getting AI-driven platforms to recommend your products more often—and rank them higher when they do.

For a primer on how AI interprets product information—and to understand the key concepts and terms used in this blog—we recommend reading our first article in this series, “How AI finds products.”

How products get recommended by AI

First, we broke down how AI and machine learning makes connections between shopper queries and product datasets. In the following sections, we’ll cover the factors that make product listings stand out and rank above others.

Here are two of the most important concepts sellers should understand if they want to improve product visibility and performance in AI-powered discovery systems:

- Why some products don’t appear at all

- Why some products rank higher than others

Keep reading to uncover how AI turns a basic product search into a competitive sorting process, and rewards listings that are more complete, better aligned with user preferences, and more likely to convert.

Why some products don’t get recommended by AI

AI-powered discovery systems don’t always surface every relevant product—and that’s not necessarily a flaw. In multivendor environments, AI has to make ranking decisions based on performance signals, data quality, user behaviors, and platform rules. Even a seemingly great product can get limited visibility if it falls short in any of these areas.

This section breaks down the most common reasons products aren’t surfaced, what AI algorithms do to improve the quality of results, and what ecommerce sellers can do to be included in relevant recommendations.

1. Incomplete, inconsistent, or low-quality product data

AI systems depend heavily on structured data and unstructured data to make product recommendations.

What’s structured data?

Structured data is product information organized into standardized catalog fields—like GTIN, color, size, material, brand, gender, price, and availability. Because it follows a consistent format, it can be easily read by machines and mapped to filters, dropdowns, and search features.

Missing or inconsistent structured data reduces a product’s chances of being accurately matched, ranked, or included in filtered searches.

An example of how poor structured data hurts visibility

An ecommerce listing for a women’s waterproof hiking boot has a strong title and description, but the category field is too broad. It’s only categorized as “Footwear” instead of “Footwear > Outdoor > Hiking Boots.” This may exclude it from filtered queries or category-based clustering.

Meanwhile, unstructured data provides AI with contextual signals that support semantic matching. When unstructured data works together with structured data to reinforce rather than contradict what AI is seeing, it means AI is more likely to surface a product for a given query.

Wait, what’s unstructured data?

Unstructured data is product information that doesn’t fit into predefined fields—like descriptions, customer reviews, or captions in images and videos. It’s less organized, free text, but rich in context, helping both shoppers and AI understand the product’s meaning and appeal.

An example of how unstructured data can add context

A shoe described as “navy” in the [color] field may not appear in a search for “dark blue running shoes” unless “blue” is also mentioned in the title or description. Listing “navy” in the structured color field with “dark blue” added in the description reinforces semantic understanding and strengthens match potential.

How Feedonomics helps improve data quality for AI search

Feedonomics is a product feed management solution that makes it easy to map, optimize, parse, and transform data. Sellers use Feedonomics to fill in as many product attributes as possible and create complete listings, which improves search ranking and relevance.

By using business rules that automate data transformation, it’s possible to parse data from descriptions to create structured bullet points, or even conditionally add keywords to descriptions. For example, you could create a rule like this: If the [color] field says “navy” and the [description] contains the word “navy,” then in the [description] turn “navy” into “navy blue.”

Feedonomics also has powerful AI tools for granular and accurate categorization, ensuring AI platforms can decipher listings with confidence.

Additionally, listings are kept updated across channels, so when you make changes to your structured data they are reflected everywhere. This consistency in your structured data helps AI make recommendations with greater confidence as well.

2. Popularity bias in AI ranking and recommendation engines

One of the trickiest challenges for AI-powered recommendation systems is what’s known as popularity bias. In simple terms, it means that products, posts, or listings that already perform well—those with more clicks, views, purchases, or likes—tend to get shown more often. And the more they’re shown, the more they continue to outperform.

It’s a self-reinforcing, data-driven loop: popular items become more popular simply because they’re popular. Think about platforms like Netflix, where the home screen often shows the top ten trending shows or movies. This can be useful for giving users an entry point with content that has performed well—or in ecommerce, content that’s likely to convert—but it can also sideline equally relevant or better-performing newcomers that haven’t yet had a chance to gain traction.

AI countermeasures

To prevent every user from having the same impersonal customer experience, many recommendation systems use diversity-aware algorithms that occasionally surface lesser-known listings to see how they perform. A 2024 study published in User Modeling and User-Adapted Interaction found that these strategies can promote fresh content without lowering overall recommendation accuracy.

For ecommerce channels, this balancing act is key: reward success, but still give new listings a chance to compete.

What sellers can do

Sellers should not wait to improve the quality of their product listings and content. Early adopters of best practices are rewarded because they can start to build traction before competitors. And latecomers can always catch up thanks to machine learning algorithms that refresh recommendations and value quality data.

- Use ads or promotional campaigns to seed early engagement

- Improve listing quality to win in novelty trials

- Optimize low-performing listings to boost engagement and relevance signals

Advertise on more channels with Feedonomics

How Feedonomics helps sellers account for popularity bias

The first takeaway is this: early adopters of data optimization best practices are rewarded. The sooner you can start building traction and getting AI recommendations, the more you benefit from the popularity bias feedback loop.

But the second takeaway is that it’s never too late, and the best time to improve your data quality is today. That way, when the algorithms refresh recommendations, your listings are highly optimized and easy to understand.

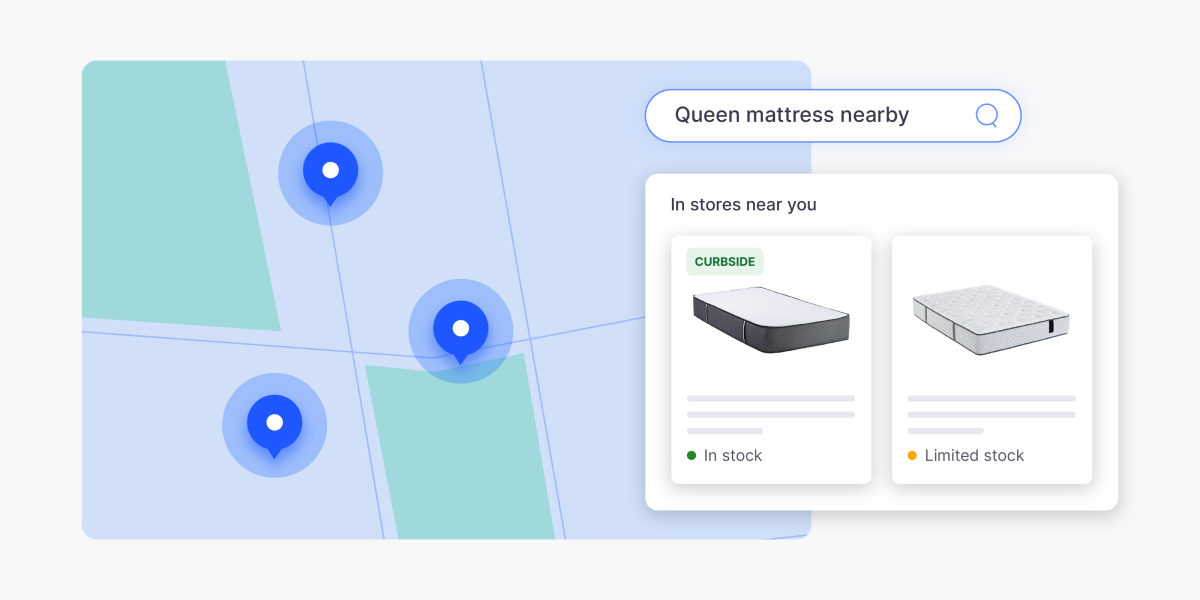

3. Session context and shopper behavior

AI doesn’t just evaluate listings—it evaluates context. Search results can shift depending on the shopper’s device, location, browsing history, or even the time of day to provide more personalized experiences.

For example, a shopper in Minnesota searching for “trail shoes” in winter may be shown insulated options, while someone in Arizona sees breathable mesh varieties.

Platforms also use collaborative filtering, which means listings that convert well among shoppers with similar behavior may be prioritized, even if other listings are technically more relevant. Customer satisfaction is an important factor for ranking.

Collaborative filtering is different from content-based filtering, because content-based filtering makes recommendations based on a customer’s previous behavior, rather than making recommendations based on the preferences of similar users in a demographic.

This is also why newly added listings may not appear in AI recommendations immediately: they haven’t yet built up performance signals or behavioral relevance. There might not be enough purchase history or user engagement for recommendation algorithms to confidently surface a product.

What sellers can do

Ensure listings contain use-case signals (e.g., seasonal fit, climate-ready language)

Use promotional activity to build early behavior data for collaborative filtering

Keep listing language broad enough to perform well across shopper profiles

How Feedonomics helps amplify contextual signals

Advertising is one of the most straightforward ways to start generating user engagement with a product listing.

Feedonomics makes feed-based advertising easy, so product listings start generating engagement right away. Channel experts build feeds to meet the requirements and best practices of every advertising channel, and help resolve errors quickly to get the feed live.

Marketers can apply custom labels to the product feed and segment products for campaigns that target seasonality or specific use cases. It’s also possible to A/B test different product descriptions, titles, or other optimizations and track the metrics of different marketing strategies.

4. Listing staleness and activity signals

AI systems often interpret inactivity—such as outdated feeds, missing inventory updates, or lack of engagement—as a potential signal of lower quality or relevance. This doesn’t mean you need to rewrite your product copy every few weeks, but it does mean listings with no recent data signals may gradually fall in the rankings.

Example: A jacket listing that hasn’t seen updated price, stock, or engagement data in months may quietly lose visibility—even if it’s still technically available and well-written.

AI countermeasures

Most platforms prioritize listings that demonstrate ongoing relevance, either through behavioral performance or active catalog updates. In some cases, systems apply freshness scoring as a secondary ranking factor to keep results timely.

Again, this doesn’t mean you need to constantly update the content on your listing. In fact, changing a high-performing listing too frequently (e.g., tweaking titles or descriptions unnecessarily) can hurt if it disrupts the behavioral signals AI has already learned to trust.

What sellers can do

- Ensure your product feed is syncing regularly and accurately

- Keep inventory, pricing, and availability fields up to date—even if content stays the same

- Re-promote older listings that have slowed in engagement to generate new performance signals

How Feedonomics helps keep listings fresh

Feedonomics can automatically refresh products listings on an automated schedule, or through the use of trigger-based Event Driven Sync. You can keep your pricing and availability current across systems, platforms, and channels.

Sellers also use Feedonomics to align content across channels, or apply changes to some listings but not others. For example, you might want shorter or more playful product descriptions on TikTok Shop, but more technical and informational product descriptions on Amazon and Walmart.

5. Platform suppression and policy filters

In some cases, products don’t appear due to policy violations, disapprovals, or formatting errors that are unrelated to any algorithmic ranking.

Example: A product missing a GTIN, using prohibited language, or including a noncompliant image may be suppressed—even if everything else is optimized.

What sellers can do

- Monitor channel-specific diagnostics and suppression reports

- Ensure all structured fields meet marketplace requirements

- Use feed management tools to catch compliance issues across platforms

How Feedonomics helps with compliance

Any ecommerce seller will tell you that some listing errors are inevitable when you send your products to ad channels or marketplaces. Google, Amazon, TikTok, eBay, and other channels all have unique data requirements and differently formatted valid values. Whether you’re submitting your data through an API connection or uploading a spreadsheet manually, you still have to match each site’s schema to have your products listed.

Feedonomics helps sellers prepare their data in a few ways. First, our feed specialists are familiar with the requirements of different channels and have a few workflows to set up the feed correctly. An initial data review gives sellers a list of required fields and data that they’re missing, plus additional recommended attributes that will boost performance.

Feedonomics also has a data validation dashboard that catches missing or improperly formatted data for different channels. When a feed goes live, the goal is to have as many product listings approved as possible, so sellers can start generating sales while the remainder of errors are resolved.

Summary: visibility requires signals and structure

AI doesn’t arbitrarily ignore products—it relies on the information and signals sellers provide. If your product isn’t showing up, it’s often because the listing lacks one or more of the qualities AI systems associate with relevance, performance, or compliance.

Feedonomics improves your data quality for better performance

Why some products rank higher than others

Once a product listing is eligible to be shown in search or recommendation results, it enters a competitive evaluation phase. This is where AI systems decide which listings should appear first—and which ones get pushed down.

Unlike traditional keyword-based sorting, modern AI systems use a mix of semantic similarity, structured data quality, and behavioral performance signals to rank listings relative to each other. In markets with many similar products, that ranking can make the difference between winning the sale or not being seen at all.

To understand more about semantic retrieval and AI search, see our previous blog, “How AI finds products.”

AI doesn’t rank in isolation, it ranks relatively.

AI doesn’t evaluate your product on its own merits. It evaluates it in context, alongside dozens of others that also match the query.

If five sellers offer comparable trail running shoes, AI has to decide which one to show first. Relevance is just the baseline. Ranking is based on who sends the strongest signals of performance, clarity, and engagement at the right time.

What affects the rankings in AI product discovery

Once multiple products are considered relevant, AI systems weigh a variety of factors to decide how to order them.

These include:

1. Behavioral signals on the platform

At the ranking stage, behavioral signals become some of the most influential inputs AI systems consider. These signals help the algorithm determine which products are resonating with real shoppers.

When user data indicates that a product consistently earns clicks, purchases, or longer viewing times, it signals to the platform that the listing is effective—and likely to satisfy future shoppers as well. As a result, these behavior-driven metrics can strongly influence which listings rise to the top.

Here are the key behavioral signals most commonly used:

- Click-through rate (CTR): How often users click your listing when they see it.

- Conversion rate (CVR): How often those clicks turn into purchases.

- Engagement signals: Time spent on page, scroll depth, add-to-cart activity.

Example: Two listings for “lightweight trail running shoes” might look similar. But if one consistently gets more clicks and purchases, AI will prioritize it—even if the other has a slightly better title or price. This ties into that popularity bias feedback loop we explored earlier.

2. Shared tokens and semantic clarity

Even in semantic search, listings that contain more of the words or “tokens” used in the query are often ranked higher. As discussed in “How AI finds products,” shared tokens act as confidence boosters for the AI and are similar to keyword matches in SEO. However, in AI-driven searches, every part of a listing is tokenized.

Imagine a shopper searches for “Best trail running shoes.” If Product A is titled “Lightweight Trail Running Shoe” and Product B is titled “Performance Cross-Trainer,” Product A is more likely to rank higher, even if they both serve the same purpose functionally. That’s fairly straightforward.

Now imagine if both products are titled “Performance Cross-Trainer,” but Product A’s description says “durable trainer with good traction for trail running,” and Product B’s description says, “Perfect for hiking, running across rugged terrain, or functional strength workouts.” Even though Product B could match the user’s query intent—a shoe for running on trails—Product A has more shared tokens with the query and likely ranks higher, assuming all other variables are equal across listings.

It’s also important that tokens don’t impede clarity by showing up inconsistently in your structured data fields. For example, you wouldn’t want to say “hiking” in your product category, “running” in your title, and “cross-training” in your bullet points to cover all your bases.

Reinforcement—the act of supporting or clarifying a term by pairing it with a more commonly used or semantically aligned phrase—can help AI make the correct association. In the example of Product A’s description, “trainer” is interpreted to mean “shoe” with the added reinforcement of “trail running.”

Key terms defined:

Tokens

Tokens are the individual words or components that AI extracts from a search query or a product listing.

- Analogy: Think of tokens as the building blocks AI uses to determine meaning. When a product listing shares tokens with a shopper’s query—like “trail,” “running,” or “lightweight”—that overlap can increase its relevance score.

Semantic retrieval

A method where AI retrieves products based on meaning, not just exact keywords. It uses vector comparisons to return listings that are close in intent—even if the wording is different.

- Example: A product search for “eco-friendly laptop case” could retrieve products labeled “recycled neoprene tech sleeve.”

3. Data completeness and structure

AI doesn’t just look for products that seem relevant. It looks for listings that are easy to understand, complete, and trustworthy. That starts with structured data.

While most sellers fill in the required fields, the best-performing listings tend to also include as many recommended and optional fields as possible. These additional attributes—like additional images, product type, age group, pattern, product type, or variant dimensions and features—help AI systems refine rankings and improve confidence in the product’s match to shopper queries.

Example: A listing for “Women’s Waterproof Hiking Boots” may include required fields like title, price, and availability, but if the seller has the option to populate additional fields like terrain, ankle height, insulation type, and activity, the listing is more likely to show up when a shopper searches “insulated trail boots for cold weather hikes.”

Granular categorization = better discovery

AI uses category hierarchies to cluster similar listings and narrow results efficiently. Applying overly broad categories to a product listing, like “Clothing” or “Footwear,” limits a product’s ability to surface in filtered or facet-based discovery.

Granularly categorizing a product as “Apparel > Women > Activewear > Hiking Pants” is far more useful to AI than simply labeling it “Pants.” It reduces ambiguity and ensures the product gets grouped with true peers—not loosely related items.

It’s also a good best practice for essentially any shopping channel, as the benefits are the same. Remember that you want to optimize your data to be machine-readable, but also provide a better customer experience. With more accurate and granular categorization on different channels, your products can appear in sections of a website that recommend similar products, or appear in the right place when users filter results.

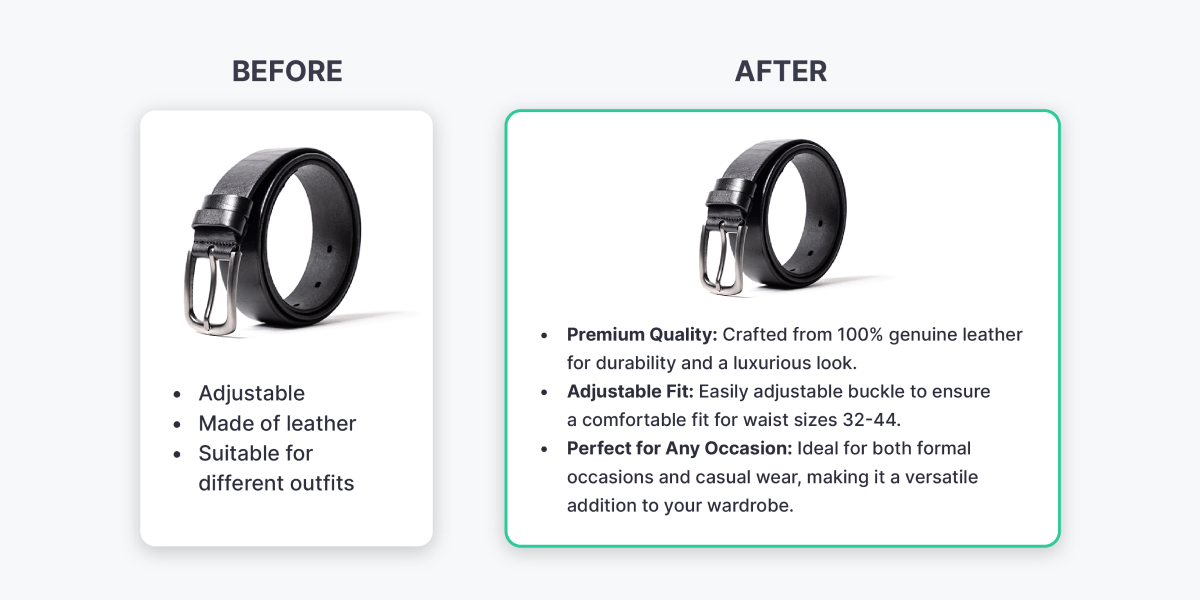

Bullet points, feature parsing, and structured copy

AI models don’t just read text—they scan it for clarity and extractable attributes. Bullet points and consistent formatting help AI systems identify key features quickly and associate them with relevant queries.

With Feedonomics, sellers can:

- Extract bullet points or feature highlights from unstructured descriptions

- Bulk apply shared attributes (e.g., waterproof, organic, made in USA) across product groups

- Create channel-specific copy variations without breaking structure

This kind of enrichment ensures that product features aren’t buried in long text blocks, but are instead surfaced where AI and shoppers can act on them.

Sync inventory and pricing to build AI trust

Machine learning models track product availability and fulfillment history to make recommendation decisions. If a product is often out of stock or has erratic pricing updates, platforms may suppress it—or avoid recommending it again.

Erratic pricing updates refer to frequent, inconsistent, or seemingly unstable changes in price that may not align with competitor behavior, market trends, or internal logic.

Examples of what this might look like:

- The price of a product changes significantly every few days without a promotion or seasonal reason.

- Price drops and jumps frequently in ways that seem disconnected from availability, demand, or campaign activity.

- The listing shows different prices across platforms due to feed mismatches or sync issues.

AI models may interpret this kind of fluctuation as a lack of reliability or signal quality. If the pricing field frequently changes, AI may have trouble learning how the product performs at any consistent value point. It also introduces risk for shoppers, as unstable prices can erode trust or lead to misalignment with promotional offers and comparison engines.

On the other hand, out-of-stock doesn’t always mean “bad.” In fact, it can indicate popularity and demand.

However, from an AI discovery standpoint, platforms are generally optimizing for what’s purchasable right now. So even if a product’s prior performance was strong, AI systems will often:

- Suppress it temporarily while it’s unavailable

- Prioritize in-stock alternatives to avoid shopper frustration

- Hold back recommending it in high-traffic placements (ads, “similar products,” auto-suggestions)

The real risk is when a product goes in and out of stock frequently—especially if that behavior isn’t aligned with consistent re-stocking timelines or if it leads to broken buyer journeys. In those cases, platforms may eventually deprioritize the listing altogether, assuming it can’t be reliably surfaced.

Help AI platforms trust your listings and continue surfacing them for high-intent queries by maintaining accuracy in the following areas:

- Stock levels

- Price changes

- Shipping times

On channels like Google Shopping or Meta, data mismatches can lead to listing disapproval or feed suppression. Automatically syncing your data is a crucial component of ecommerce success, and the closer you can get to real-time syncing, the better.

Read this case study about Euro Car Parts to learn how Feedonomics helped this auto parts supplier maintain accurate inventory levels and streamline its processes across channels.

4. Image quality and quantity

Visuals aren’t just cosmetic. High-quality images drive more clicks and time of engagement, especially on mobile, where visual scanning is dominant. And because AI systems interpret engagement as a sign of relevance, better images can actually improve your product’s ranking over time.

In addition, some platforms evaluate image quality at the catalog level, scoring your visual assets as part of a broader listing health metric. So having clear, complete, and well-optimized imagery isn’t just good for users—it’s a competitive advantage in AI-driven environments.

Quantity matters, too. Listings with multiple high-resolution images tend to perform better because they allow shoppers to see the product from different angles, in context, and in use. This builds confidence, increases time spent engaging with the listing, and often leads to higher conversion rates.

5. Listing freshness and activity

As mentioned above, AI platforms may stop recommending stale listings if they aren’t confident that the data is accurate. Updating stock quantities or prices, gathering recent reviews, and having engagement signals can indicate a listing is active.

A high-performing listing that hasn’t changed in months may still rank well, but one that shows signs of decay in engagement may slowly drop.

To help keep engagement high on your listings, you can connect your product feed to remarketing campaigns and also improve customer retention by reminding them of previous purchases or offering new deals.

6. Competitive price or offer positioning

AI doesn’t always reward the lowest price, but it does factor in how well your offer aligns with shopper expectations for value. That decision often comes down to offer-level signals, such as:

- Pricing competitiveness (relative to other sellers of the same or similar item)

- Customer reviews and ratings

- Shipping speed and cost

- Return policy transparency

- Fulfillment method, such as whether the product is enrolled in a preferred logistics program like Amazon FBA or Walmart Fulfillment Services (WFS) if the search happens on the marketplace

If two sellers list the same air purifier for $129, but one offers faster shipping and has better reviews, AI may prioritize that listing—even if the title, image, and structured data are otherwise similar.

What sellers can do

- Monitor pricing trends in your category to avoid appearing out of sync

- Bundle value signals—e.g., “Free 2-Day Shipping” or “30-Day Returns”—into listing descriptions or offer metadata where supported

- Enroll in platform-preferred fulfillment programs if available to you (e.g., WFS, FBA, Buy with Prime)

Give your ecommerce listings the best chance to rank in AI search

AI-powered search engines reward listings that combine clarity, completeness, and performance. To rank higher:

- Audit your listings regularly: Ensure product titles, structured data, and attributes are clean and complete.

- Optimize your data to include query-aligned tokens, showcase use-cases and important features in bullet points and key highlight sections.

- Use search term reports (on platforms like Amazon or Walmart) to improve token alignment with real queries.

- Generate engagement on new listings with paid advertisement and marketing campaigns. Ads and promotions can jumpstart behavioral signals that influence organic ranking. Solicit reviews to give AI platform unstructured data that adds valuable context.

- Refresh slow listings: If engagement drops, try new images or minor copy tweaks to re-engage shoppers. Use remarketing strategies to bring shoppers back.

- Test and iterate: Even small changes in title structure or image format can improve CTR and downstream ranking.

- Include FAQs and answer common questions on your product detail pages when possible, to give AI more context about your products.

- Keep your listings up-to-date with accurate pricing and inventory levels. This increases trust in your listings and makes them easier to recommend to shoppers.

Help AI search platforms rank your products

How AI ranks and recommends products FAQs

What is a user-based recommendation system in ecommerce?

A user-based recommendation system identifies similarities between shoppers and suggests products that people with similar preferences have purchased or interacted with. In ecommerce, these systems analyze browsing history, clicks, and purchases to make personalized product suggestions. For example, if two users share similar shopping patterns, the system may recommend items that one user bought to the other, helping brands drive more conversions through personalization.

How does AI improve product discovery in ecommerce?

AI enhances product discovery by interpreting shopper intent and surfacing the most relevant results. Unlike traditional search engines that rely solely on keywords, AI models use semantic understanding, structured data, and behavioral insights to rank and recommend products. This creates a smarter, more intuitive shopping experience—where ecommerce customers can easily find what they need, even with vague or conversational queries.

Why do some products get recommended more often than others?

AI-powered recommendation systems prioritize listings based on performance signals like engagement, conversion rates, and completeness of product data. Products that consistently perform well—through clicks, purchases, and reviews—earn higher visibility. This ranking process ensures users see listings that are both relevant and proven to satisfy similar shoppers, especially in user-based recommendation models.

How can sellers optimize product data for AI ranking algorithms?

Ecommerce sellers can improve visibility by providing rich, structured product data that AI can easily interpret. This means filling in all available product attributes, writing clear and keyword-aligned descriptions, and keeping inventory and pricing up to date. The more consistent and complete your data is, the more confidence AI has in ranking and recommending your listings accurately.

What’s the difference between user-based and content-based recommendation systems?

User-based systems recommend products based on the behavior of similar users, while content-based systems focus on the attributes of the items themselves—such as color, size, or material. In ecommerce, combining both approaches gives shoppers the most relevant experience: user-based models personalize recommendations, while content-based filtering ensures AI understands product details and intent.

Mario is a senior content marketing manager based in Texas. He enjoys solving problems, learning about new ecommerce tech, and breaking down complex topics into useful tips for readers.